Mark Abelson

Workflow Automation Specialist | Quantitative and Financial Analyst – Derivatives, Treasuries, FP&A | Social Media Content Creator (Thank you for 2 million + engagements in under 5 months!)

Welcome!

Nice to meet you and welcome to my site! I’m Mark Abelson and I live in Plano, Texas. I have an A.S. in Business Administration from the County College of Morris and a B.A. in Economics from Rutgers University. My academic experiences have greatly enriched my life and I love learning new things every day.

I started my journey at One Call Care Management as a Billing Associate where I formed a solid foundation for my career to come. I then made my way to Wall Street, initially at the Bank of New York Mellon in Manhattan as an Analyst in Data Management and Quantitative Analysis, focusing on OTC derivatives pricing. Later, I joined JPMorgan Chase & Co. in Plano as a Fund Servicing Analyst in their Valuations Control Group. Following this, I worked at State Street where I managed a team of 11 senior associates and associates in derivatives pricing. My most recent position in corporate America was at Toyota Financial Services where I worked as a Financial Analyst in their Treasury Operations department.

Currently, I run a business as a workflow automation specialist. My expertise includes custom tool development, intelligent automation mentorship, and strategic consulting for business growth. For detailed insights into my professional journey and skills, please feel free to view my resume available on this site.

My custom GPT “Quant Deriv Vantage – From Wall Street to Main Street: Financial Derivatives Simplified” is live on OpenAI’s GPT Store! You can access it by clicking here: Quant Deriv Vantage (QDV) This GPT breaks down complex topics in financial derivatives in a friendly and easy way.

If you are interested in my workflow automation solutions or interested in hiring me on a corp. to corp. basis, please visit www.diamondbladeanalytics.com or drop me a line here.

Personal Interests

I love spending time outdoors, going for walks, hiking, and exploring new places in nature. I particularly love meadows, valleys, fields, rivers, and forests. I also love technology, especially building computer setups, coding/developing tools, and artificial intelligence. I enjoy staying up to date with the latest AI advancements and thinking about how they can shape the present and future. AI is super trendy!

I have a wide range of interests, especially when it comes to science, math, and space exploration. Lately, I’ve been diving into quantum mechanics—sub atomic particles and their unpredictable behavior are endlessly fascinating to me. I also enjoy learning about finance and how different economic models work. I love the challenge of understanding complex topics and finding ways to apply them in my life to my benefit.

Beyond that, I’m really into content creation and enjoy making videos for social media. My AI-based social media accounts have gained over 2,000,000 engagements in under 5 months from launch. I’ve been viral multiple times and have received so much love and support from my fans. Whether it’s sharing something I’ve learned or just experimenting with different styles, I find the creative process really fun. I also spend a lot of time watching YouTube and listening to podcasts, always looking for new ideas and perspectives.

Music is another big part of my life. I listen to a mix of genres, from folk and heavy metal to indie rock, classical, and epic instrumental soundtracks. I love how music can set the tone for any moment, whether I’m working, relaxing, or just getting lost in thought.

At the core of it all, I’m someone who loves learning, exploring new ideas, and having great conversations. I enjoy connecting with people who share similar interests and always look forward to discovering something new!

Below are some examples of various projects I’ve built, displayed to illustrate my skills and expertise. If you’re interested in workflow automation solutions for yourself or your business, please visit www.diamondbladeanalytics.com or e-mail me at info@diamondbladeanalytics.com for a free consultation.

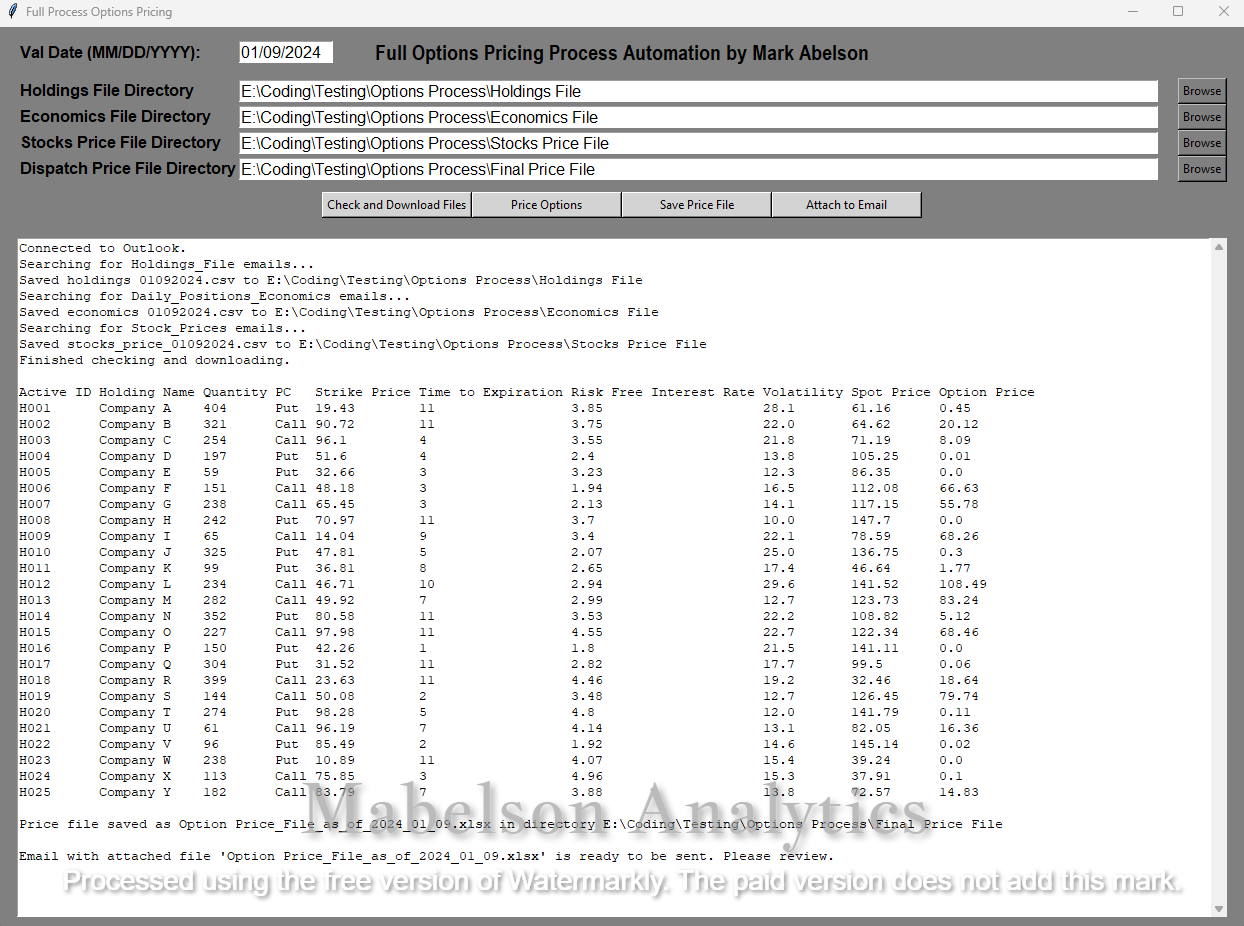

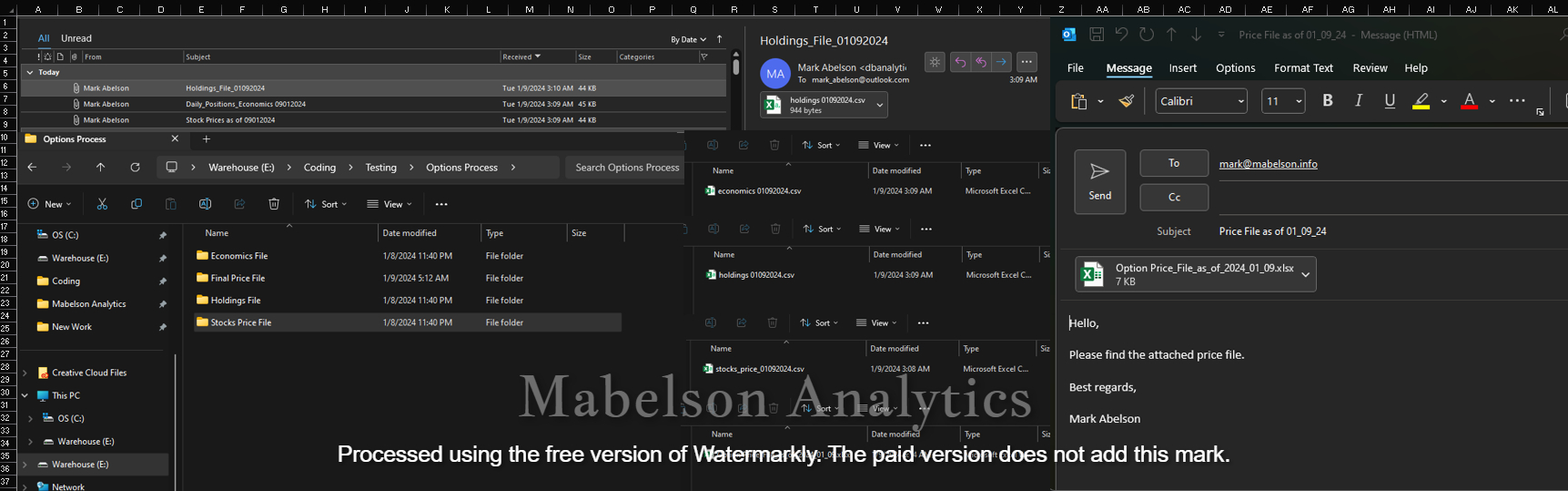

Options Pricing Process Automation Tool – Python

My Options Pricing Process Automation Tool is a streamlined system I created to automate financial data management and quantitative analysis tasks, eliminating the need for tedious manual methods. It automatically collects financial documents (e.g., “Holdings Files,” “Economics Reports,” and “Stock Prices”) from emails, integrates with spreadsheet software for data entry and formatting, and calculates option prices using the Black-Scholes-Merton model (see my full BSM Mathematical Model Formula Walkthrough project). It also identifies option types, consolidates data from multiple sources, updates prices accurately, and saves final results in a new Excel file before composing an email with the file attached. The result is a faster, more precise, and more consistent workflow, setting a new standard compared to traditional manual approaches. All economic details are solely for demonstration purposes.

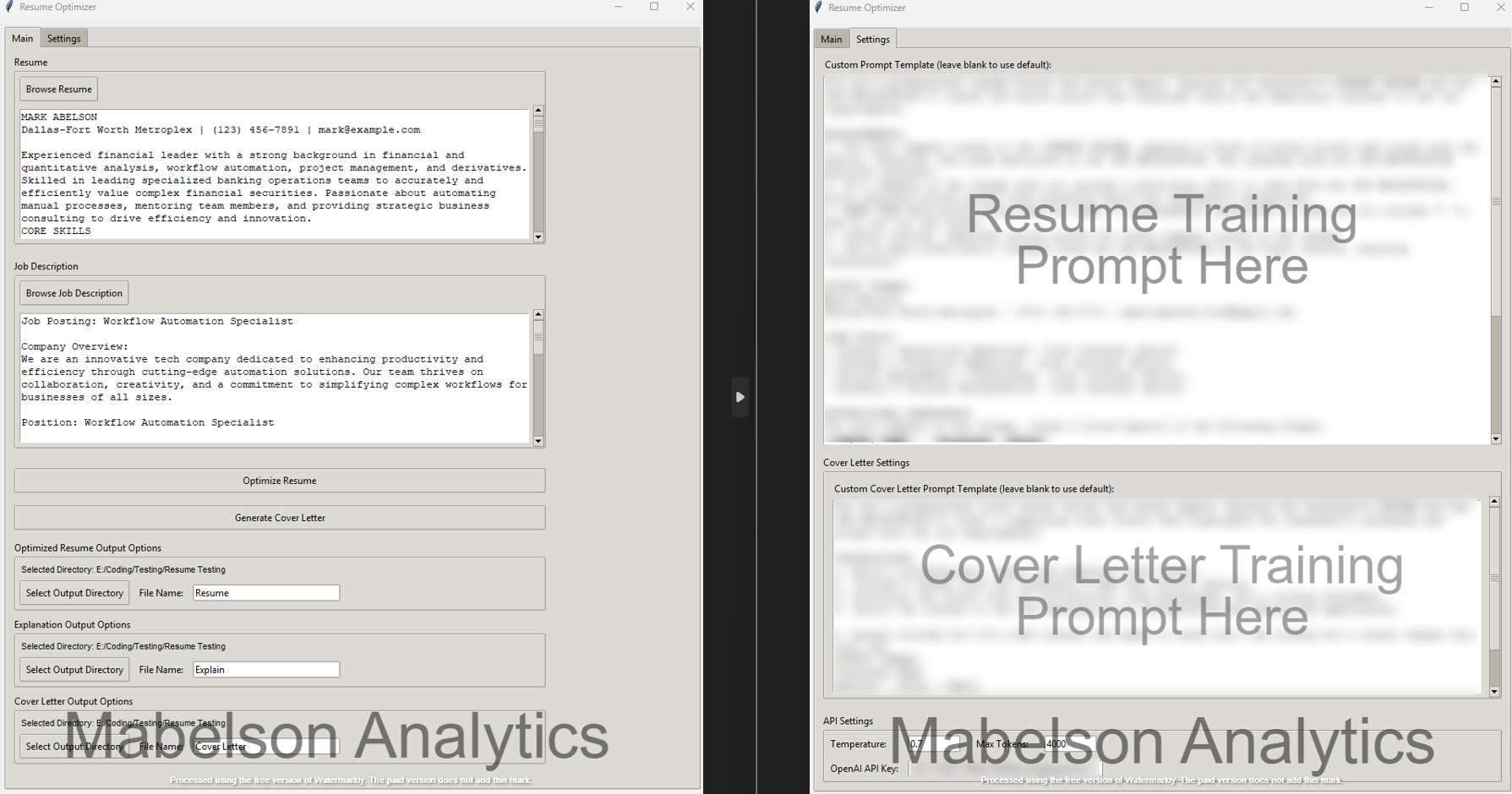

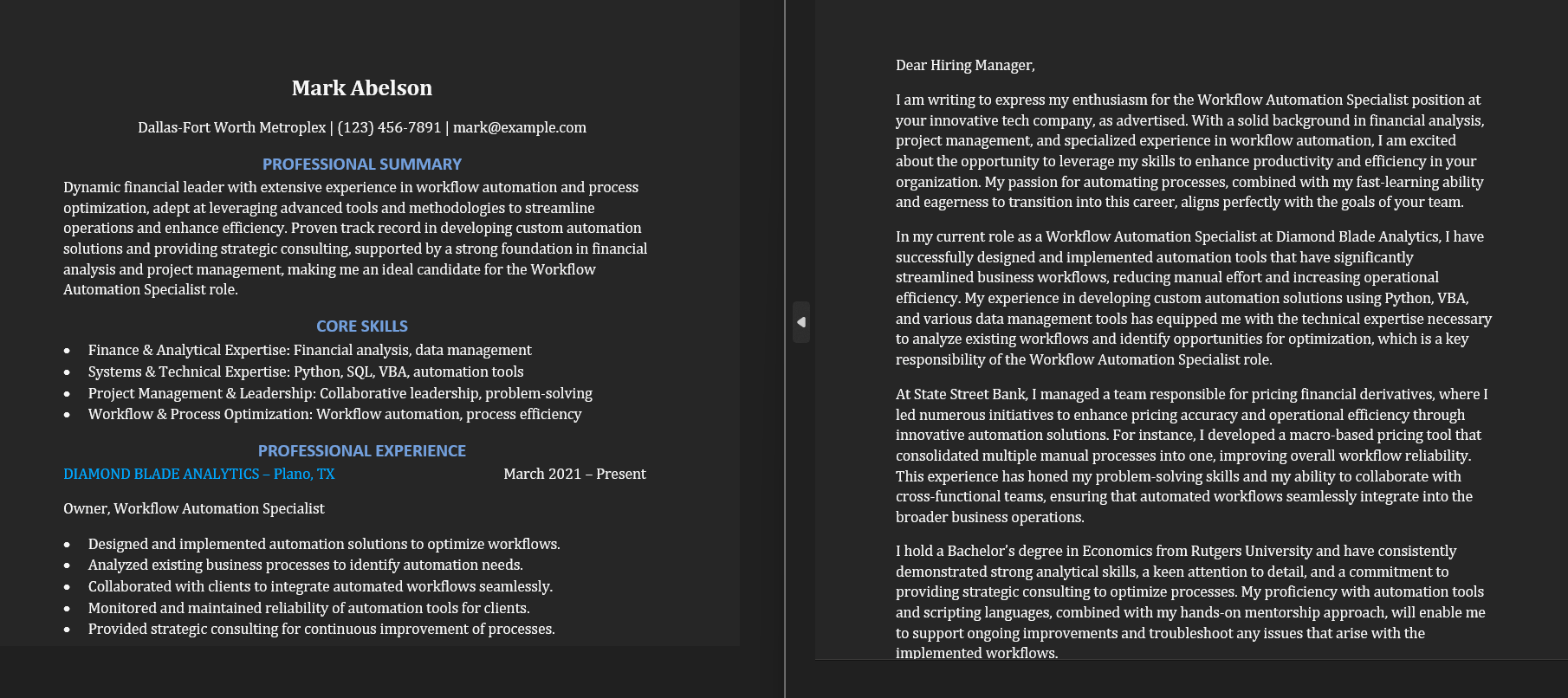

Resume Optimizer – AI-Powered Resume and Cover Letter Builder – Python

Resume Optimizer is an intuitive, AI-powered tool designed to enhance resumes and craft compelling cover letters effortlessly. By utilizing advanced natural language processing through OpenAI’s GPT-4o model, the application transforms existing resumes to align perfectly with specific job descriptions. Users simply upload their resume and job description files, and the tool generates optimized, tailored bullet points emphasizing relevant skills and experiences. Resume Optimizer features a clean, user-friendly interface built with Python and Tkinter, making it easy to manage documents, customize outputs, and generate insightful explanations for each enhancement. Save countless hours spent editing resumes by automatically creating polished, professional documents that boost job application success

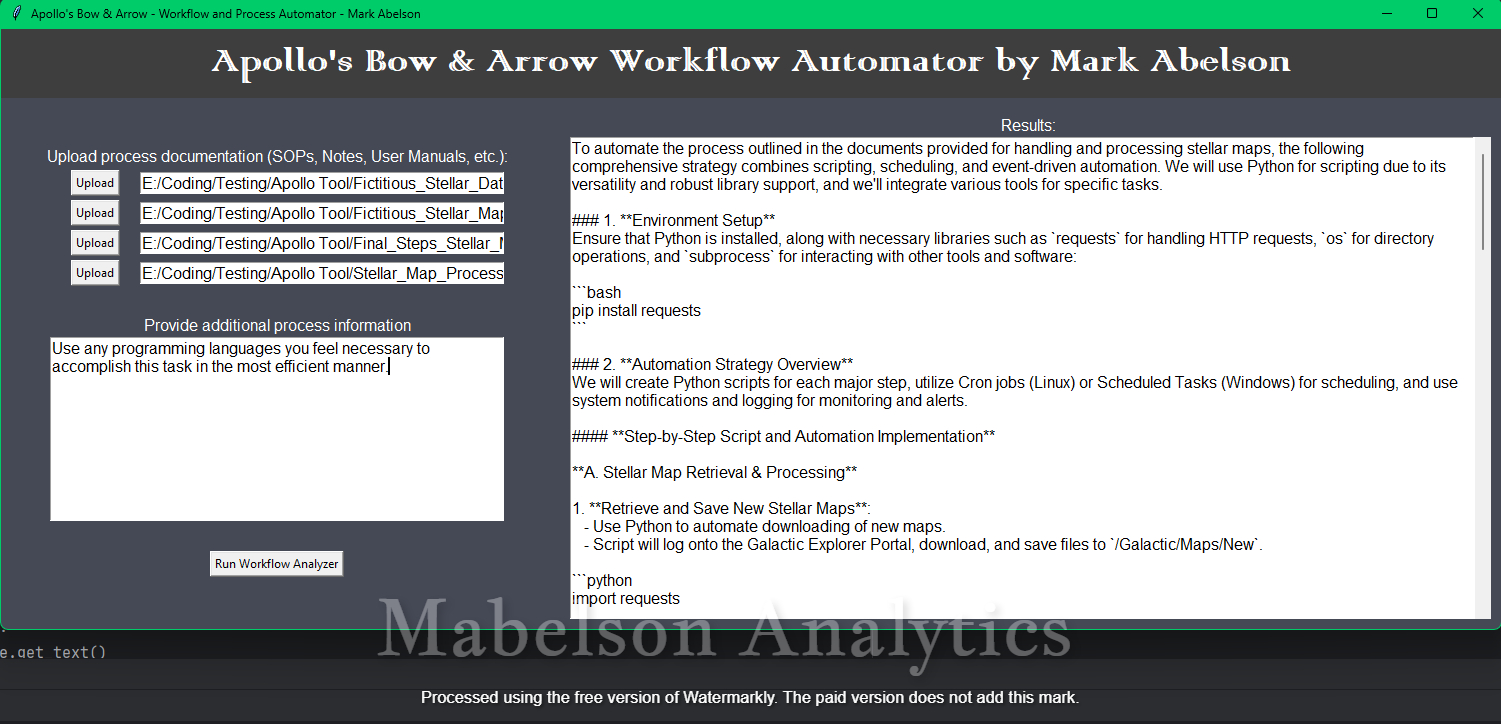

Apollo’s Bow & Arrow Workflow Automator Tool – Python

Apollo’s Bow & Arrow Workflow Automation is a technical solution I created to simplify a variety of business processes by analyzing and acting upon process-related documents. Powered by Python scripts and document parsing libraries like PyMuPDF (Fitz) and python-docx, it gathers and interprets text from standard operating procedures, technical manuals, and process notes. At its core, the OpenAI API examines the compiled data, leveraging cutting-edge machine learning and natural language processing to pinpoint the most efficient steps for completing tasks with minimal errors. It recommends a clear, optimized course of action—complete with instructions and code suggestions—to improve workflow speed and precision. By producing a detailed execution plan that outlines each task and the required software, scripts, or technologies, the tool eliminates unnecessary manual work and ensures smooth, accelerated operations.

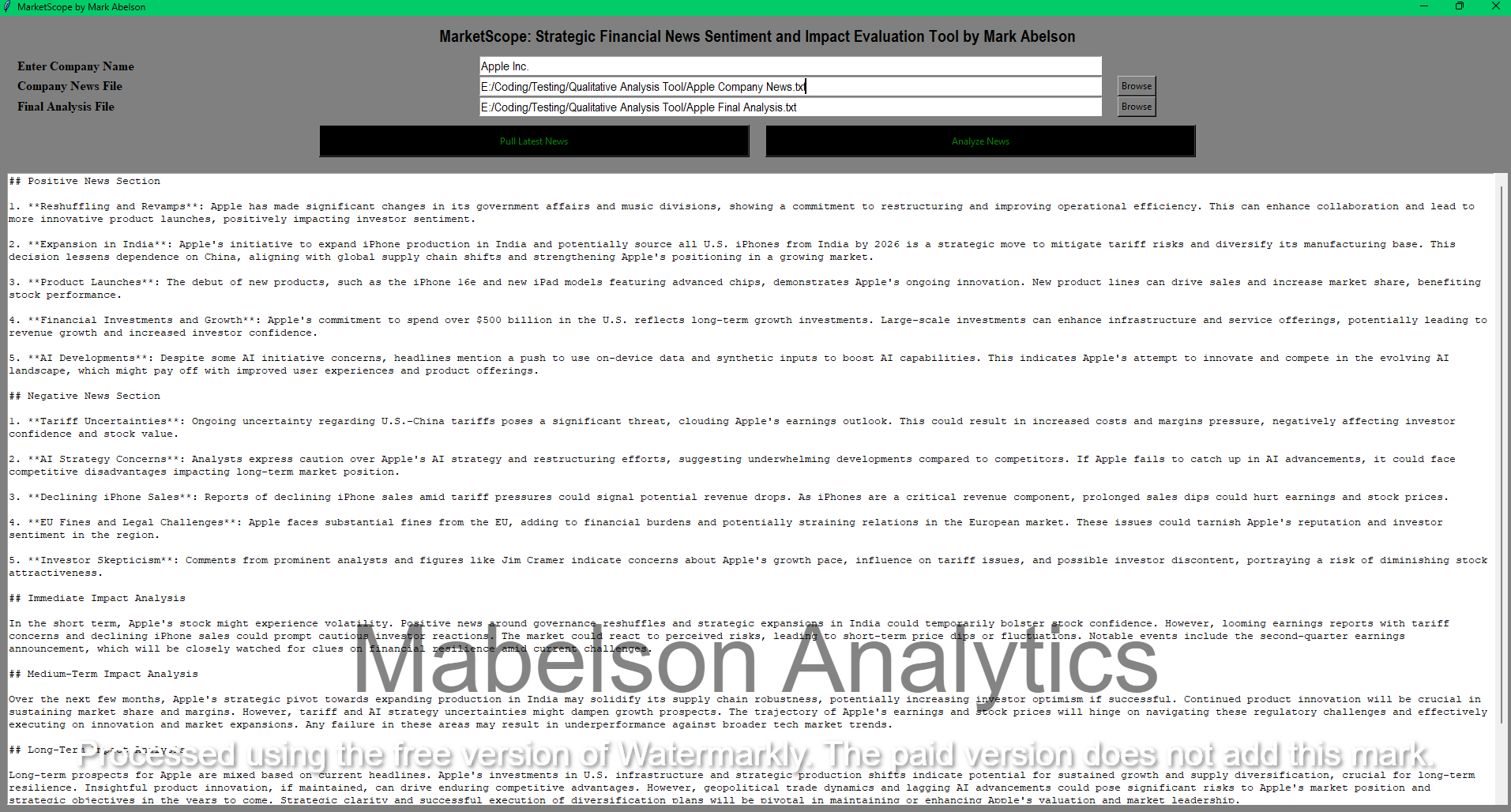

MarketScope – Strategic Financial News Sentiment and Impact Evaluation Tool – Python

MarketScope is an AI-powered financial news analysis and company assessment platform that rapidly gathers the latest headlines for any specified company, eliminating the need for manual news aggregation. With a simple user input, it uses advanced natural language understanding capabilities to process and categorize news, breaking down its impact into positive or negative sentiments and evaluating short-, medium-, and long-term implications on stock performance. By leveraging the power of the GPT-4 AI model, MarketScope provides a clear, multi-tiered financial analysis packed with logical, data-driven insights—saving investors and analysts countless hours of research. The tool delivers a comprehensive report on the potential effects of market news on stock valuation, making it a transformative solution for staying ahead in the fast-paced finance world. Results shown here are from April 2025, and MarketScope should be run daily to maintain the most up-to-date information.

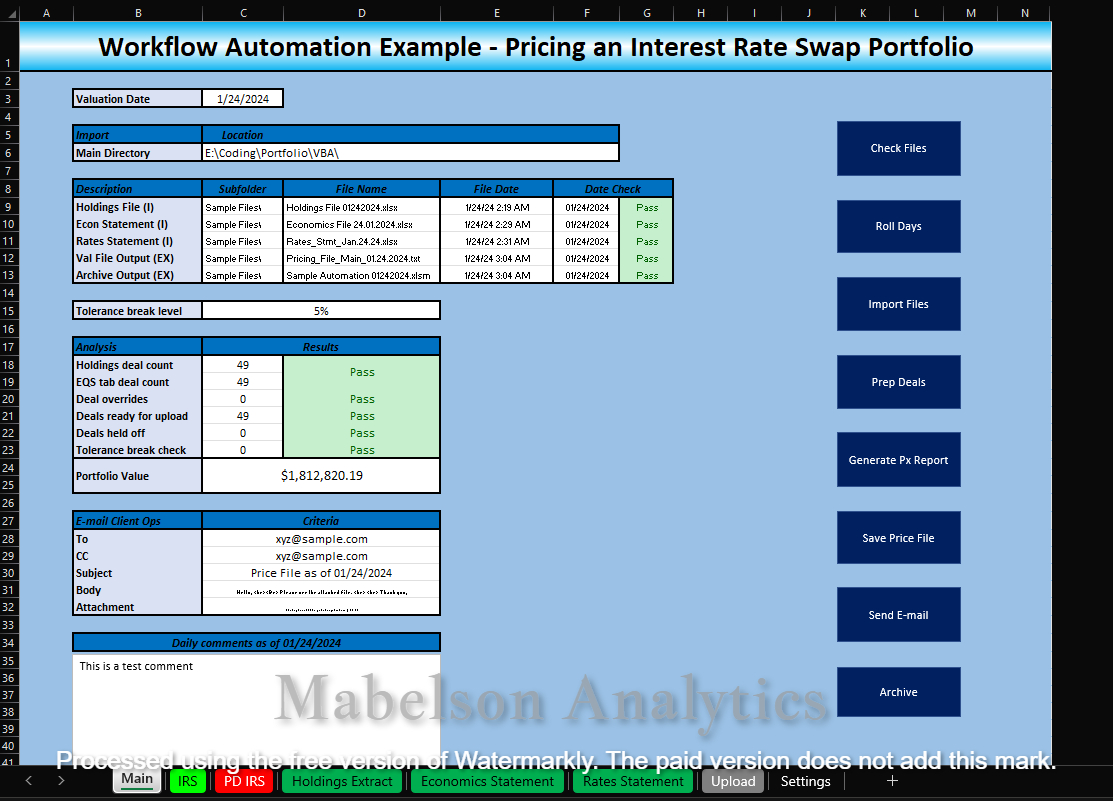

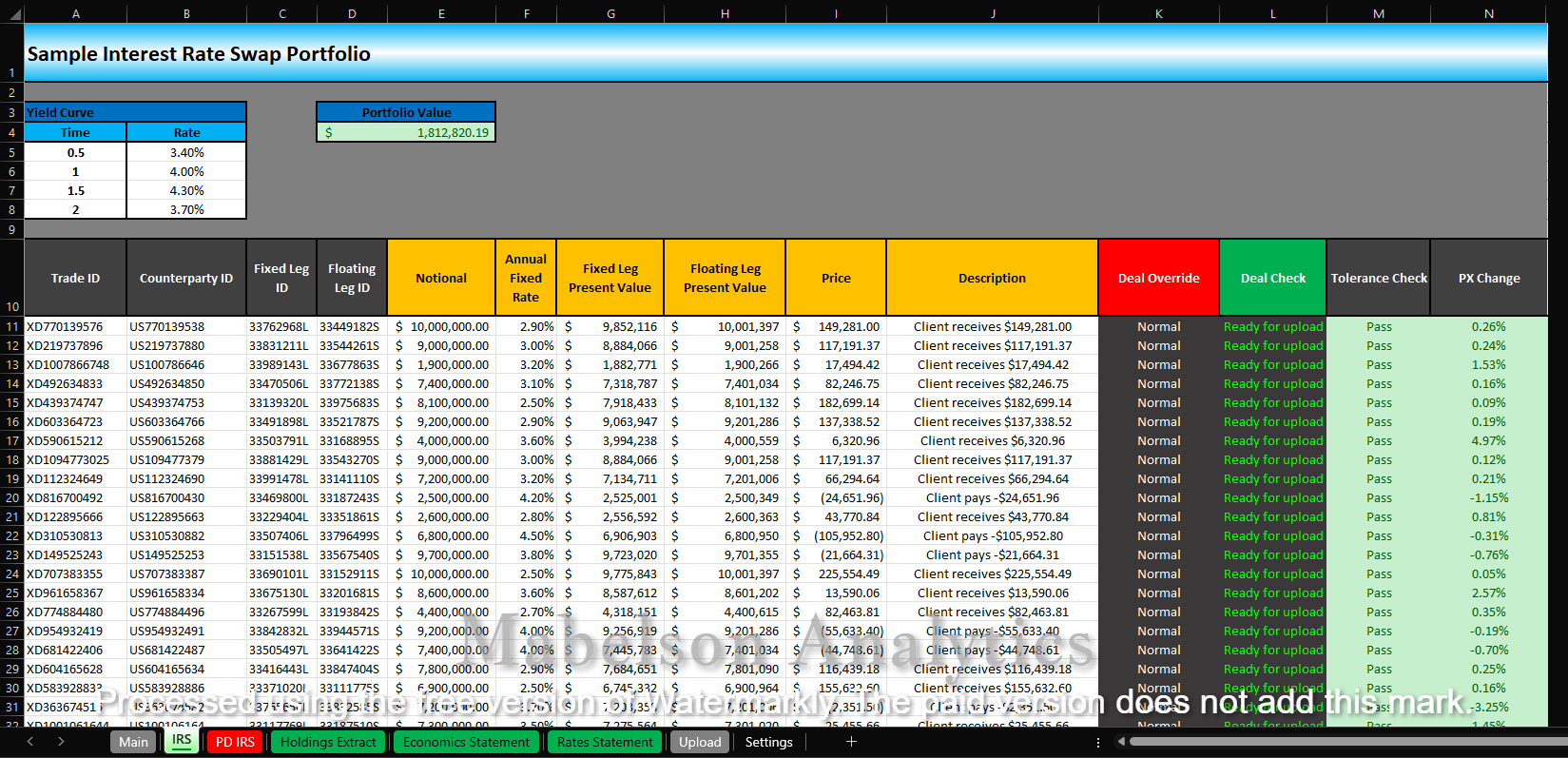

Interest Rate Swap Pricing Calculator – Excel & VBA

The Interest Rate Swap Calculator is a workflow-enhancing tool designed to simplify the valuation of interest rate swap portfolios while ensuring precision and efficiency. By integrating intuitive interfaces and automation capabilities, it handles pre-valuation checks, data import, and date updates with ease. A centralized dashboard provides a clear snapshot of the entire portfolio, showing import status, updates, and logs of completed tasks. Its key features include preparing transactions, updating open positions, generating FTP upload files, and systematically preserving pricing files for archival. The dedicated Swap Portfolio page displays each swap’s details—from trade IDs and counterparties to notional values and current prices—while rigorous validation checks (like tolerance levels and day-over-day price comparisons) maintain data accuracy. Back-end macros protect data integrity, handle file imports, prepare deals, and generate reports. All trade economics and information are purely fictional and serve demonstration purposes only.

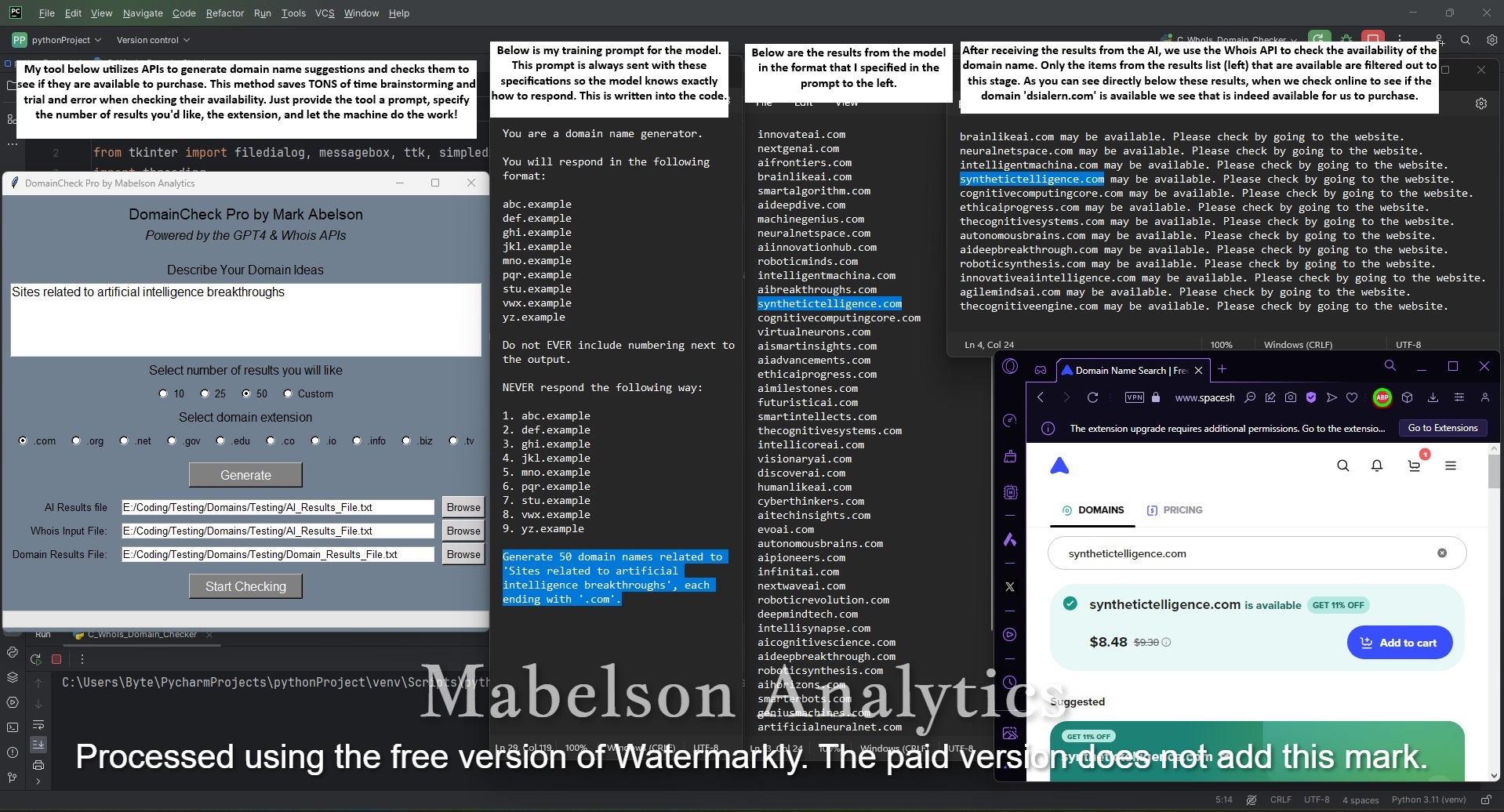

DomainCheck Pro – Python

The DomainCheck Pro is an advanced tool I created tailored for domain flipping, combining the power of GPT-4 and Whois APIs. It features a user-friendly interface, enabling users to input domain themes and choose from a variety of domain extensions like .com, .org, .net, among others. Users can specify the number of desired results, and the tool then generates a list of potential domain names using GPT-4’s linguistic capabilities. The application also includes a domain verification system utilizing the Whois API, allowing users to upload and check the availability of a list of generated domains. This feature is especially valuable for domain flippers in identifying and securing profitable domain names quickly. The tool’s interface is designed for ease of use, with functionalities such as file browsing for input and output data, customizable result numbers, and multiple domain extensions. The inclusion of a progress bar and multi-threaded processing ensures efficient and simultaneous checks of domain availability. DomainChecker Pro is a key asset for domain flipping professionals, merging creative domain generation with technical verification. Its ability to rapidly generate and validate domain names makes it an indispensable tool in the domain flipping market, aiding in more strategic and successful domain acquisitions.

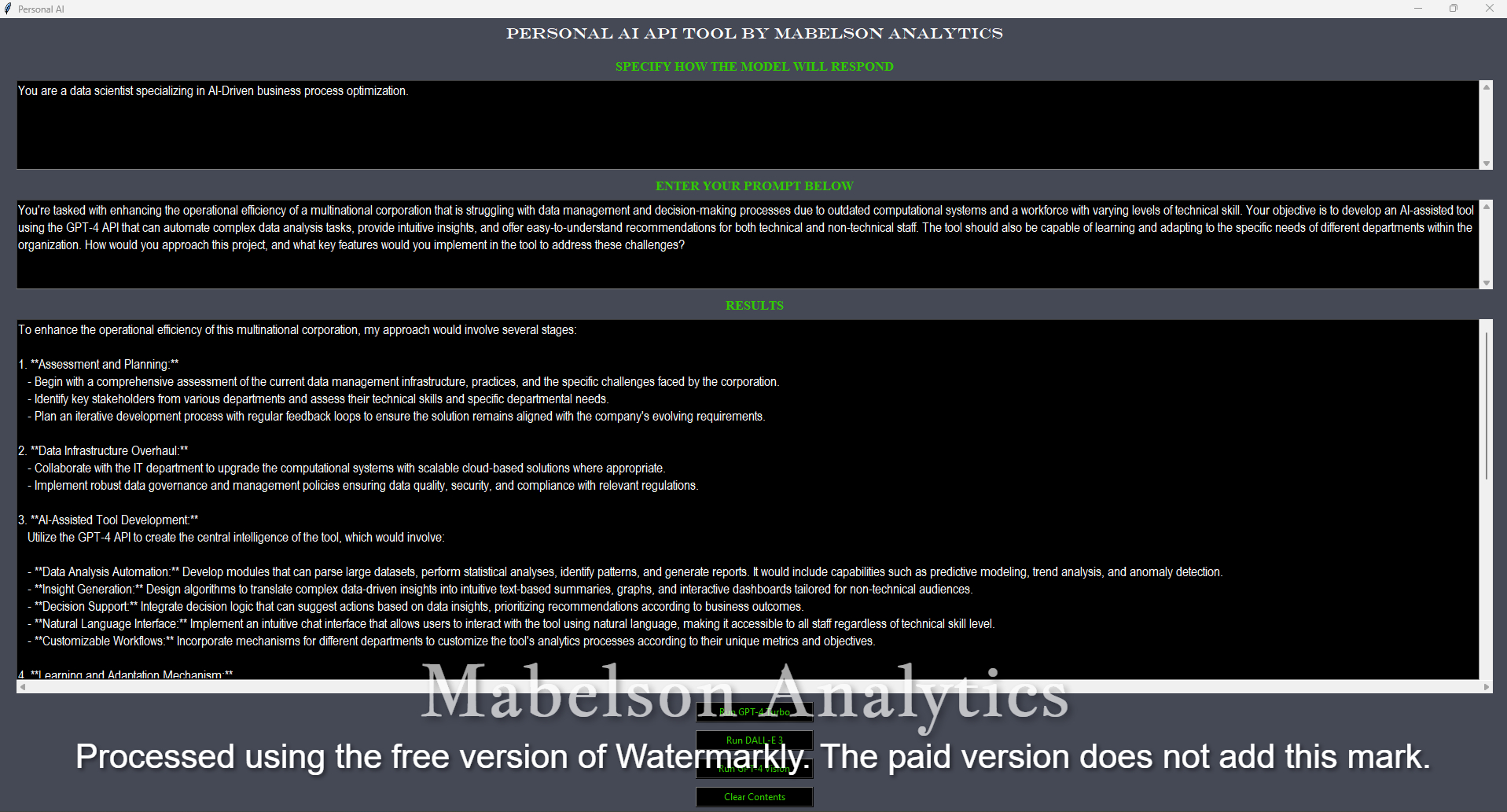

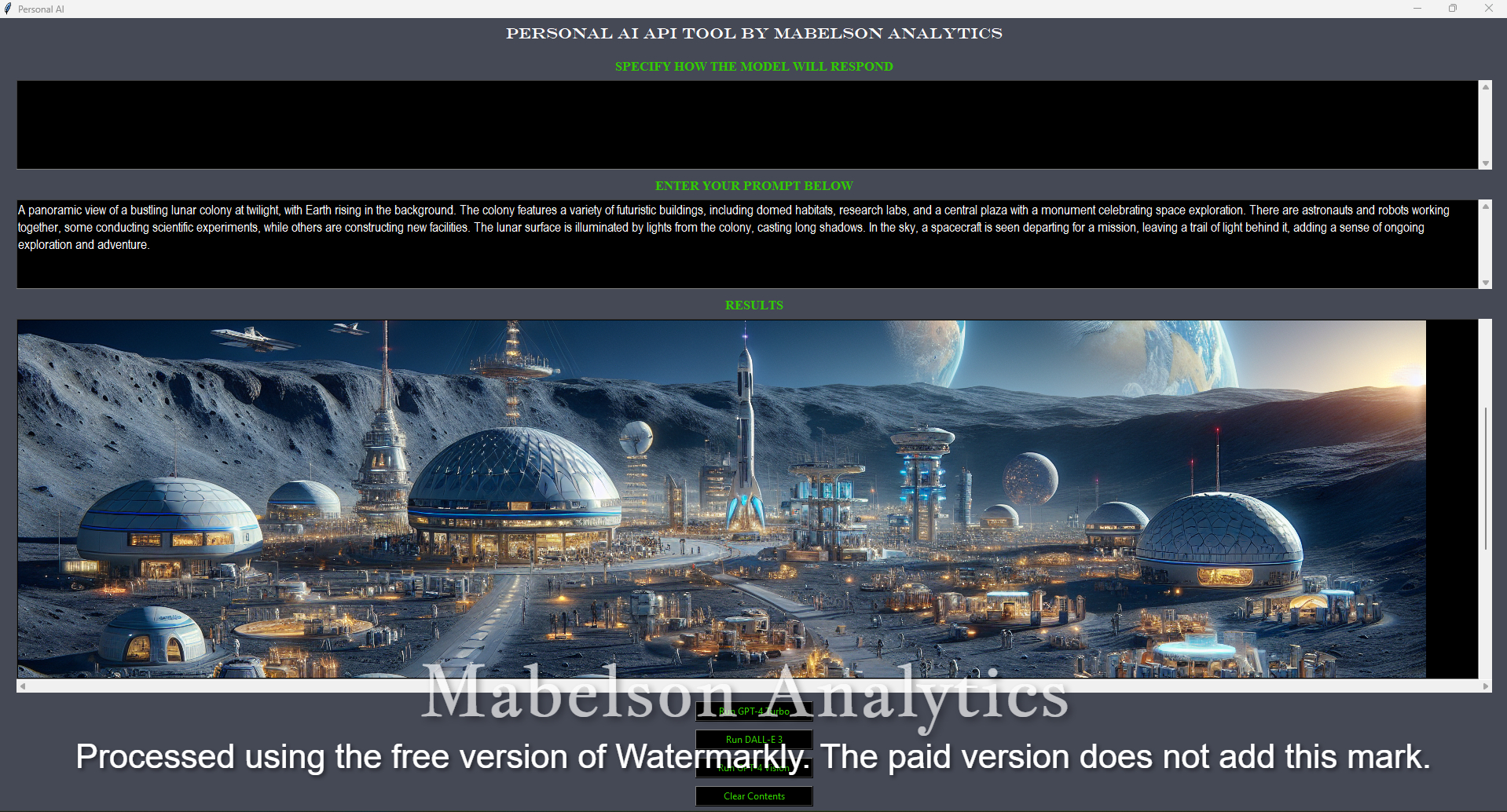

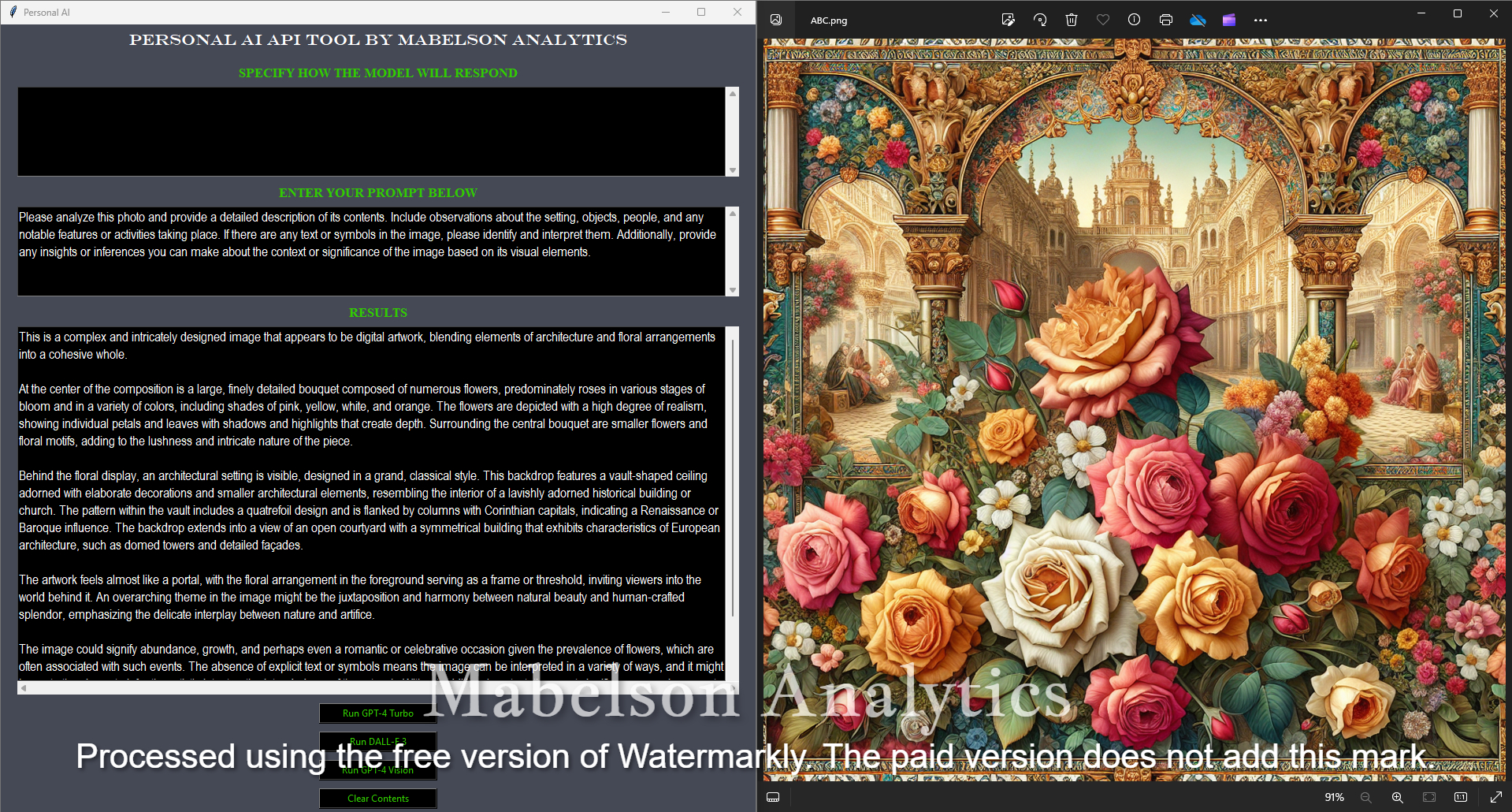

Personal AI API Tool – Python

This is my personal GPT AI API Tool. Showcased below is a state-of-the-art demonstration of the GPT-4 Turbo API’s capabilities, offering users a firsthand experience of its advanced computational power. Designed for both efficiency and sophistication, this platform invites users to engage with the language model, which is capable of constructing complex narratives and providing rapid responses to a variety of prompts. It stands as a testament to the strides made in natural language processing, enabling seamless and interactive storytelling with remarkable speed. This tool exemplifies the fusion of speed and intelligence, allowing for a seamless demonstration of the language model’s prowess in understanding and generating text. It’s an invitation to push the boundaries of AI-assisted communication, providing a glimpse into the potential for creating immersive and detailed experiences through the simple act of entering a prompt.

The DALL-E 3 photo generation feature utilizes artificial intelligence to convert textual prompts into visual images. It incorporates the latest advancements in AI image generation, allowing for the nuanced interpretation and creation of complex visuals based on user input. The interface serves as an interactive medium for users to engage with AI’s capabilities in visual cognition, facilitating the conversion of written language into high-fidelity graphical representations. Functionally, the interface provides a user-friendly environment for exploring the applications of AI in visual arts. It is designed to interpret a wide range of descriptive prompts, translating them into detailed, expressive artworks. The platform also aims to expand the boundaries of AI in the domain of creative expression, providing a space for the generation of detailed artworks from textual descriptions.

GPT-4’s image recognition feature signifies a new era in image comprehension and descriptive insight. As a part of the GPT-4 API – Personal Tool collection, this interface is designed to demonstrate AI’s capacity to analyze and articulate intricate visual scenes. It enables the AI to not only see but also to understand and describe the elements and narratives contained within an image, highlighting the nuanced details with exceptional precision. This interface is more than a mere analytical tool; it is a testament to the synergy between AI and visual understanding, showcasing how advanced algorithms can interpret imagery with a depth that rivals human perception. It invites users to witness the full spectrum of AI’s visual acuity, pushing the boundaries of machine-assisted image interpretation. This system serves as a gateway to experiencing how AI can transform visual data into descriptive language, crafting vivid narratives from the visual world.

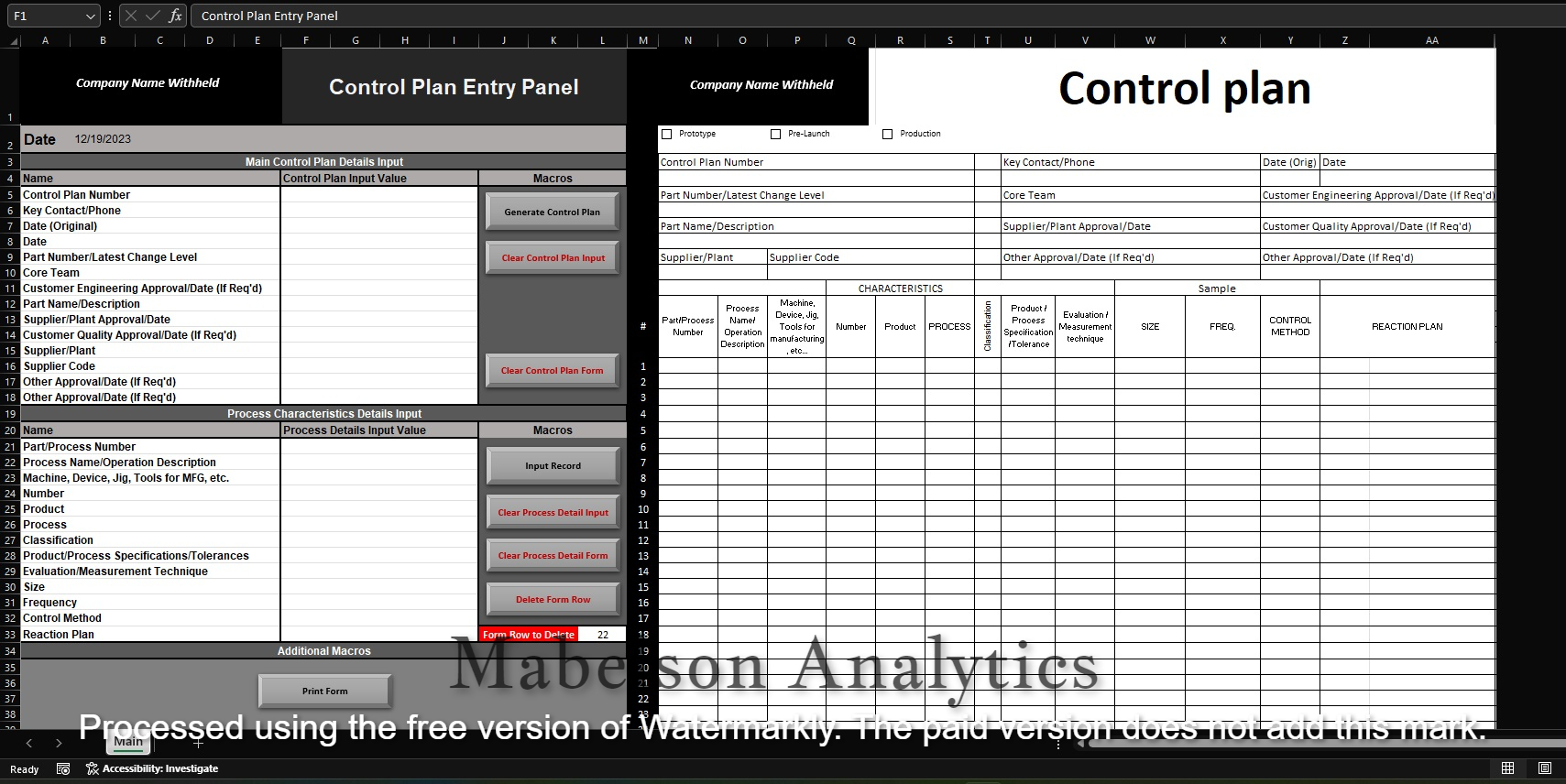

Control Plan Entry Tool – Excel & VBA

The Control Plan Entry Tool is an innovative and integral component of quality management for a manufacturing company. This dynamic interface provides a meticulous and streamlined method for entering and managing critical data needed to construct comprehensive Control Plans. It includes fields for key contact information, part numbers, descriptions, and detailed process characteristics, enabling users to input and oversee every facet of manufacturing and quality assurance with precision. Incorporated within this tool are automated macros that ensure that each entry is accurate and up to date. The panel supports the creation of a detailed Control Plan by facilitating the recording of machine, device, and tool information for manufacturing, as well as the specification of product and process tolerances. This careful structuring of data is pivotal in maintaining the highest standards of quality control, essential for achieving operational excellence in production.

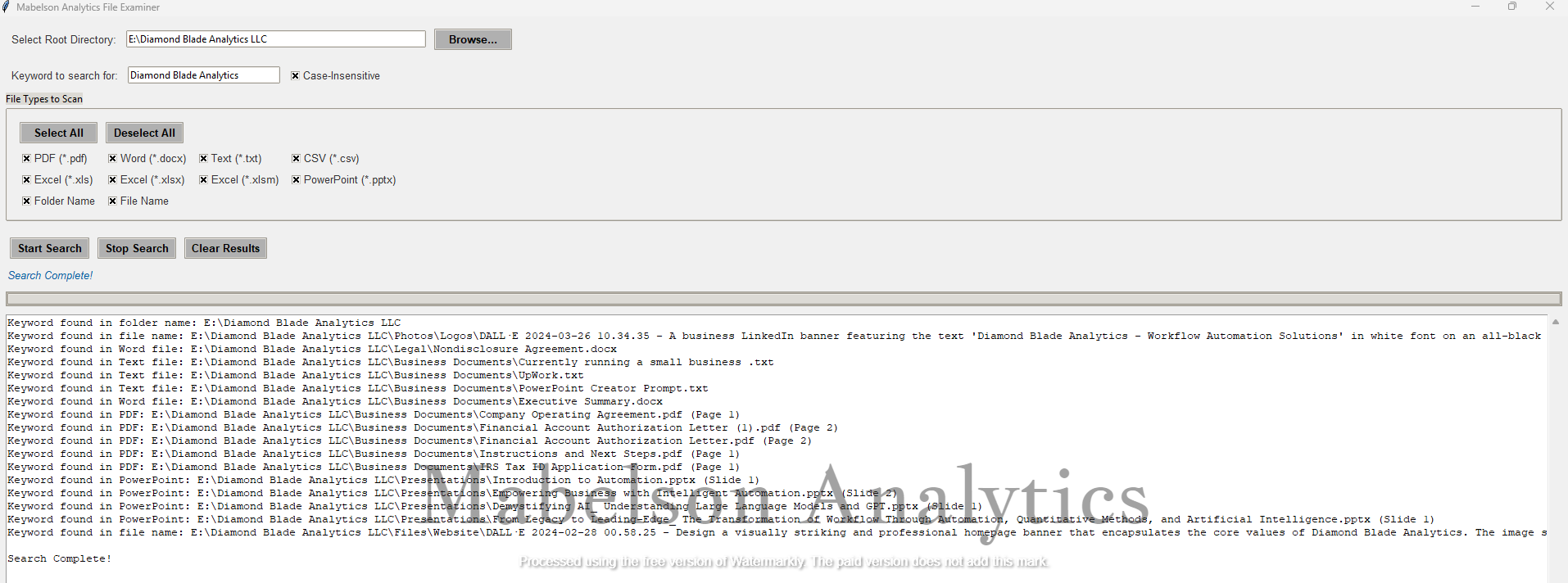

File Search Automation Tool – Python

The File Search Automation Tool is designed to streamline the process of locating specific information across multiple file formats within extensive directory structures. Leveraging Python, the tool traverses directories to search within PDF, Word, Excel, and text documents, among others. It identifies and highlights the presence of user-defined keywords, bringing pertinent data to the forefront quickly and accurately. This tool simplifies the complexity of data search and retrieval, offering a straightforward and efficient user experience. It stands as a reliable solution for rapid data access, suitable for a range of tasks that require the pinpointing of information within a diverse set of documents. Through automation, it provides a time-saving approach to file examination, enhancing productivity in data management activities.

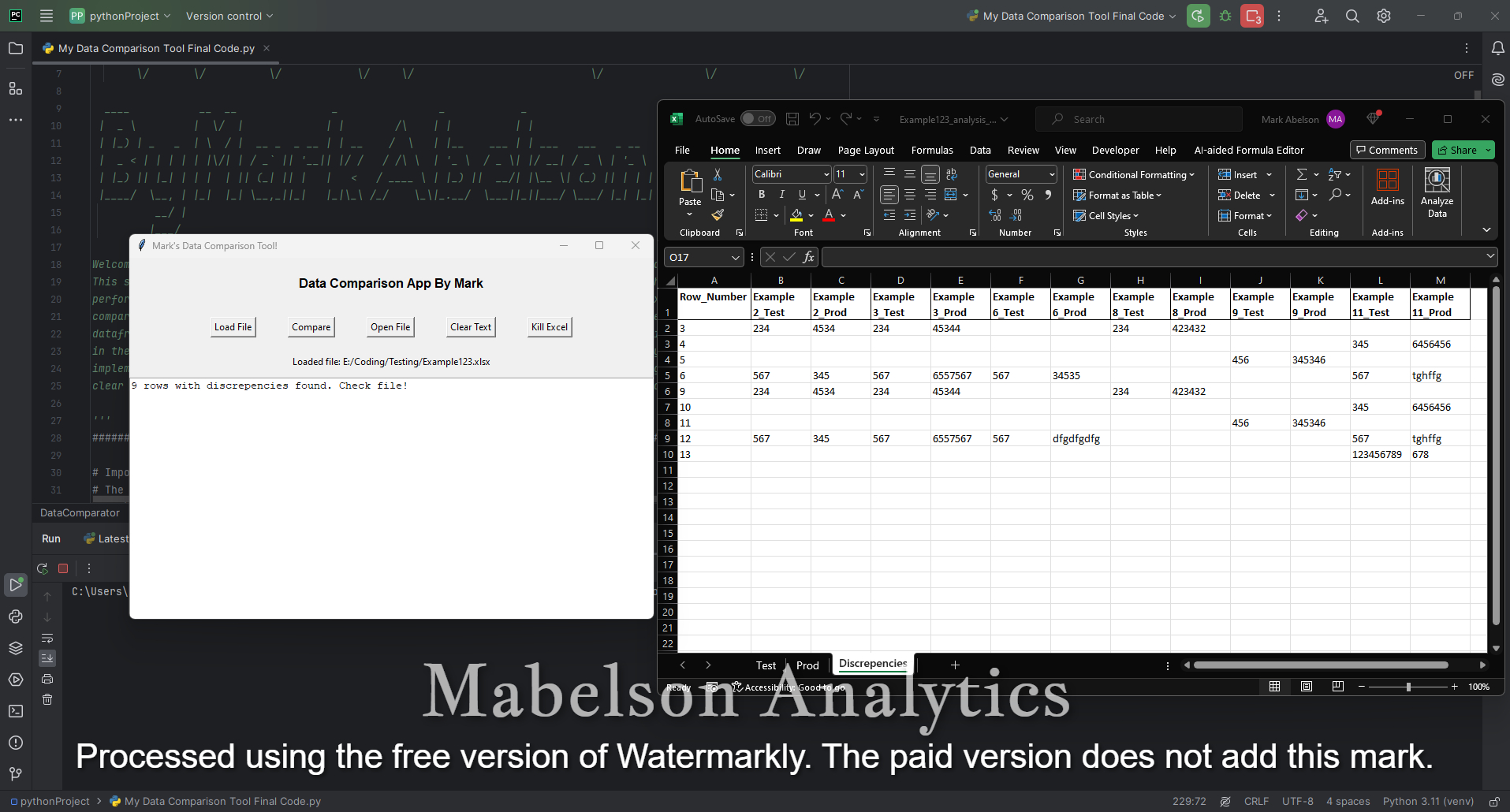

Data Comparison Tool for Parallel Testing – Python

My Python Data Comparison Tool is an innovative software solution I developed to automate and streamline the comparison of Excel-based datasets. This tool is integral in eliminating the labor-intensive and error-prone process of manually comparing data across different stages of environments, such as ‘Test’ and ‘Prod’. It seamlessly integrates with spreadsheet applications to facilitate automatic data loading, aligning, and comparison, thus replacing manual data manipulation. Central to its functionality is the robust handling of Excel files, where it identifies and rectifies discrepancies between data sets, ensuring high accuracy in data analysis tasks. It leverages the power of pandas for data management and tkinter for an interactive GUI, allowing users to load files, execute comparisons, and directly interact with the results. The tool adeptly handles discrepancies by aligning them clearly in a new Excel file, which is automatically saved in the user’s directory for immediate access and review. This facilitates a thorough examination and auditing process, enhancing workflow efficiency by reducing the time spent on data verification and validation. The Python Data Comparison Tool sets a new benchmark in data comparison, offering a streamlined solution that assures precision, consistency, and significant time savings, radically transforming traditional data comparison methods. All functionalities are designed with user experience in mind, ensuring that every interaction is intuitive and productive.

Black-Scholes Merton Option Pricing Tool – Python

My Black-Scholes Calculator is an advanced financial tool designed to streamline the understanding of options pricing using the Black-Scholes-Merton model. Utilizing Python’s robust mathematical capabilities and the scipy.stats library, it offers precision in calculating option prices and the associated “Greeks”: Delta, Gamma, Theta, Vega, and Rho. Its tkinter-based user interface allows for straightforward input of critical variables, including Stock Price, Strike Price, Time to Expiration, Risk-Free Rate, and Volatility. This calculator provides detailed outputs for both call and put options, ensuring that users have a clear and accurate assessment of options pricing. The calculated “Greeks” offer valuable insights into the risk and potential performance of the options, enhancing the understanding of options pricing.

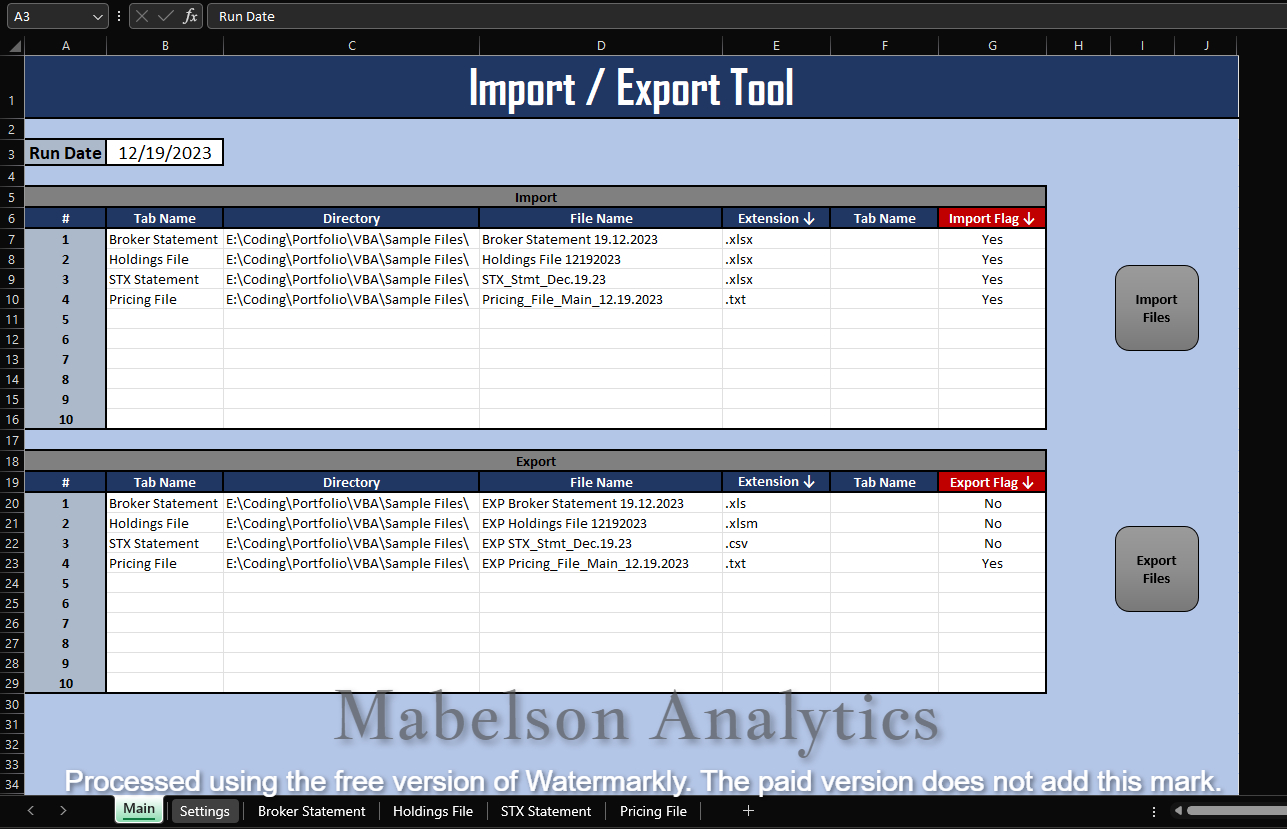

The Import-Export Tool – VBA

The Import/Export Tool is crafted to enhance productivity by providing a streamlined approach to handling data. It simplifies the import and export process across a variety of file formats, ensuring precise data management. Users can direct the flow of data with ease using simple import and export flags, allowing for a high degree of customization and control over their data workflow. This tool is designed to save time and minimize errors, making it an essential utility for those who demand efficiency and accuracy in their Excel tasks. Whether dealing with large datasets or routine data transfers, this tool ensures that your operations are both swift and reliable. It’s engineered to support professionals who rely on Excel for complex data management tasks, delivering a user-friendly interface that mitigates the risk of manual errors and enhances overall productivity. With this tool, the management of Excel data becomes a more controlled, accurate, and efficient process.

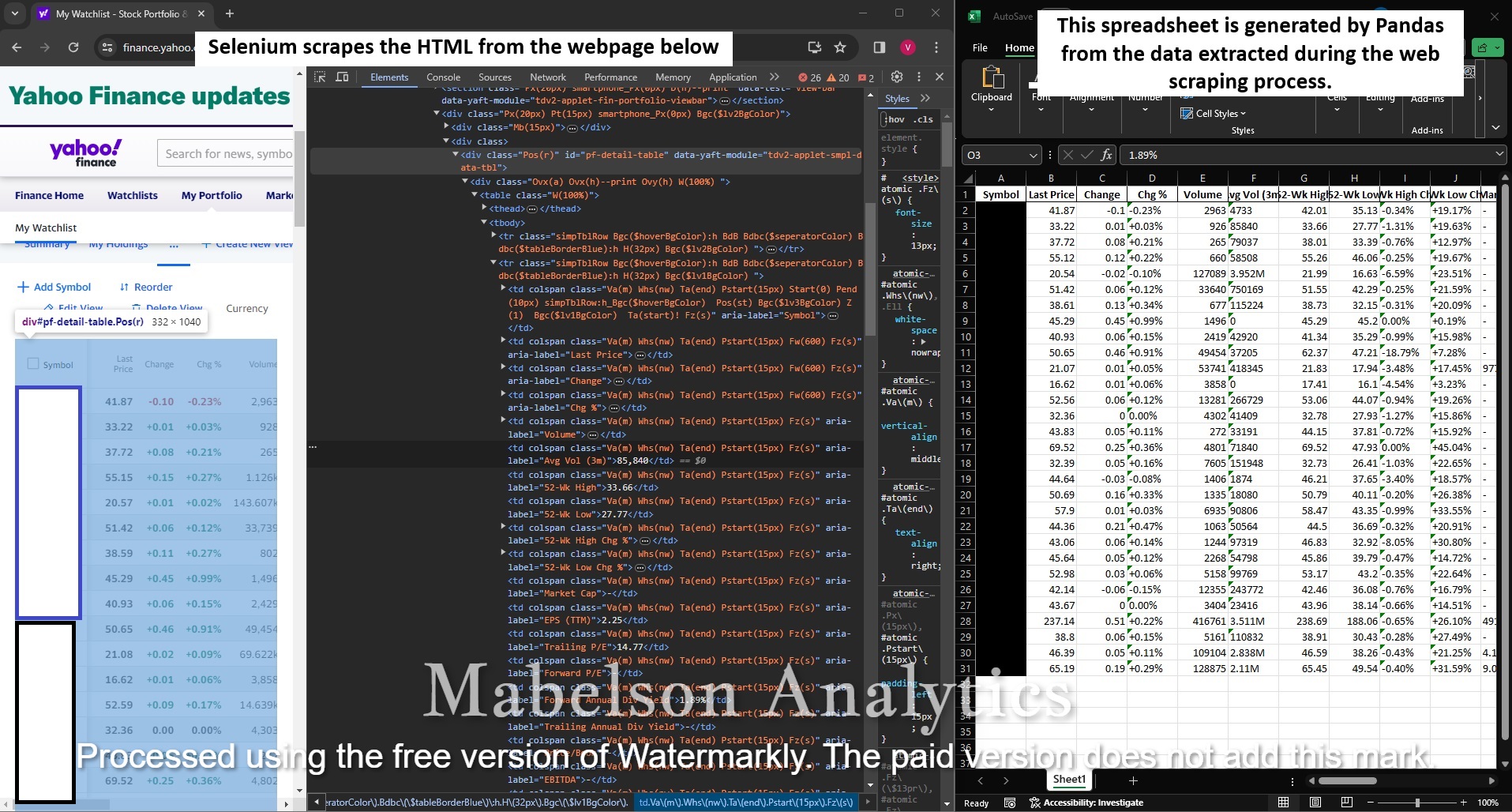

Web Data Scraper Tool – Python

The Web Data Scraper Tool is meticulously designed to enhance operational workflows by automating the extraction and processing of data from web sources. It is adept at navigating to specific web pages, such as financial portals, where it can authenticate access, extract relevant tables, and convert this data into structured spreadsheets. By employing sophisticated web automation techniques, the tool eliminates the need for manual data entry, reducing the time spent on routine data acquisition tasks. Utilizing the tool, users can automatically log in to secure websites, navigate to designated data-rich pages, and capture the necessary information. It leverages the power of Python’s Selenium and Pandas libraries to interact with web elements and parse HTML tables, respectively. The data extracted is then meticulously organized into Excel format, stamped with a timestamp for version control, and saved to a predefined directory, ready for analysis or integration into larger data systems